CFA Level 1

CFA Level 1

Quantitative Methods- Exam Ready Notes

CFA Level 1 : Quantitative Methods

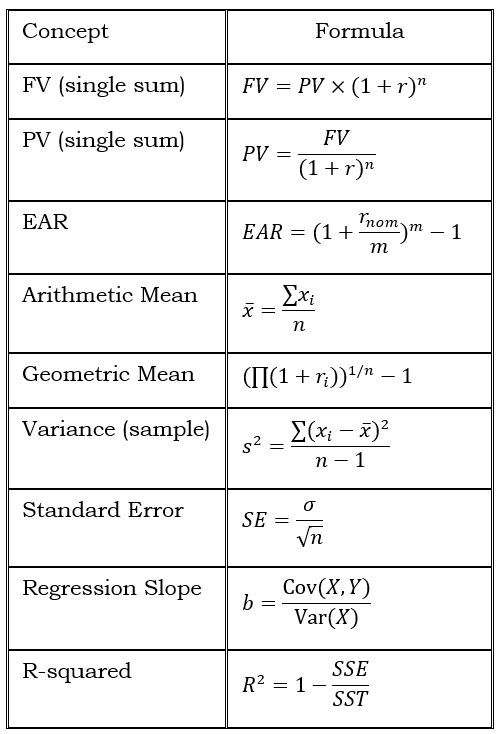

1. Rates and Returns / Time Value of Money

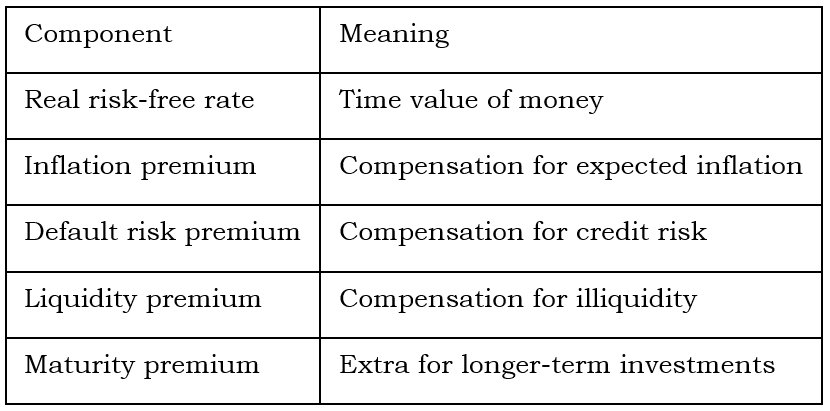

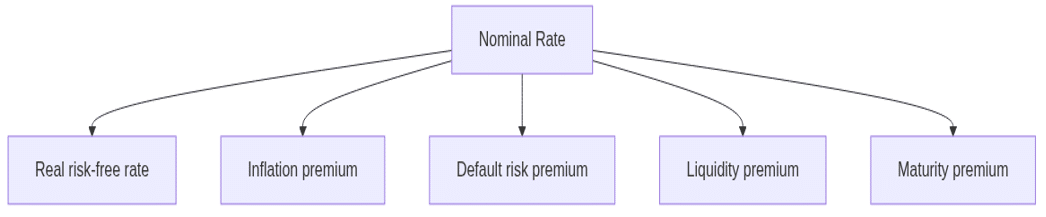

Interest Rate Components

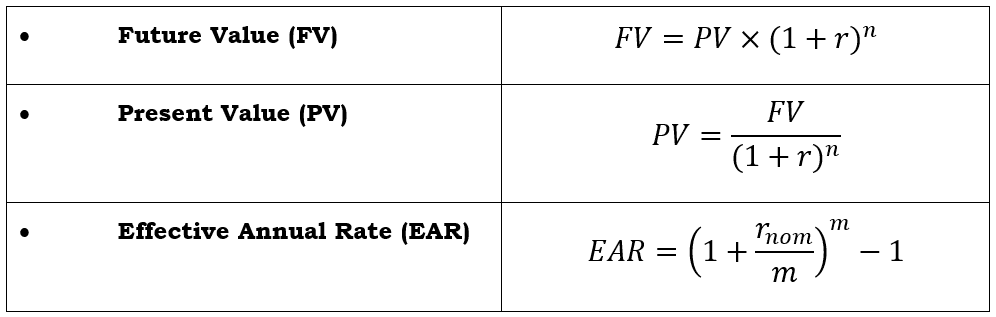

Formula:

Nominal Rate = Real risk-free rate + Inflation premium + default risk premium +Liquidity premium + maturity premium

Interest Rate Structure Diagram

Time Value of Money (TVM)

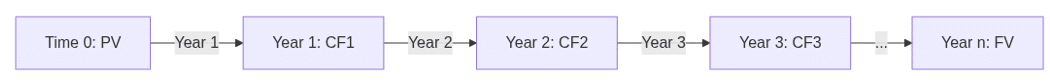

Timeline for TVM Problems

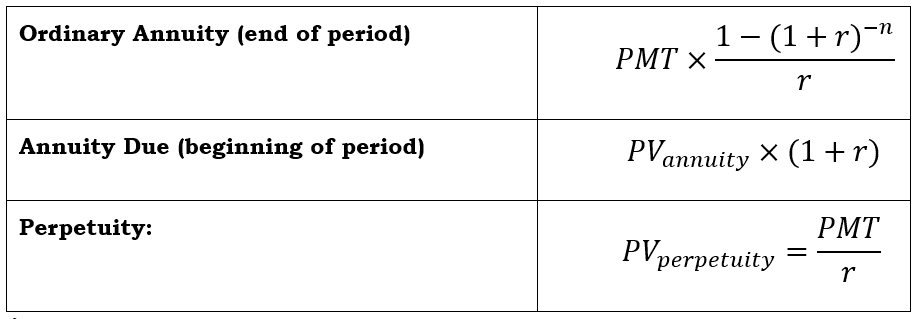

Annuities and Perpetuities

Annuity:

Ordinary Annuity: Payments occur at the end of each period (most common in loans, bonds).

Annuity Due: Payments occur at the beginning of each period (e.g., rent).

Perpetuity: Payment for infinite life

2.Statistical Concepts and Market Returns

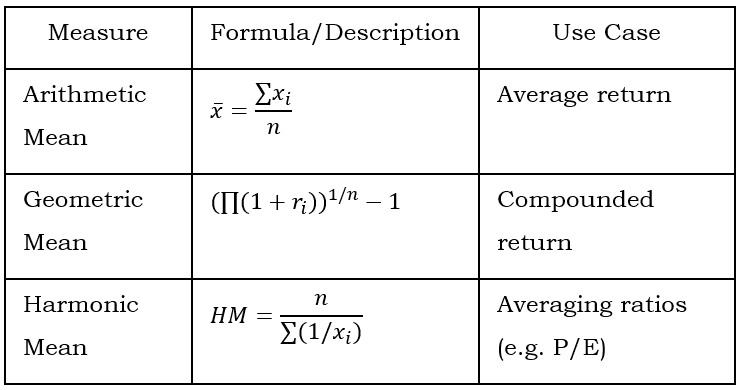

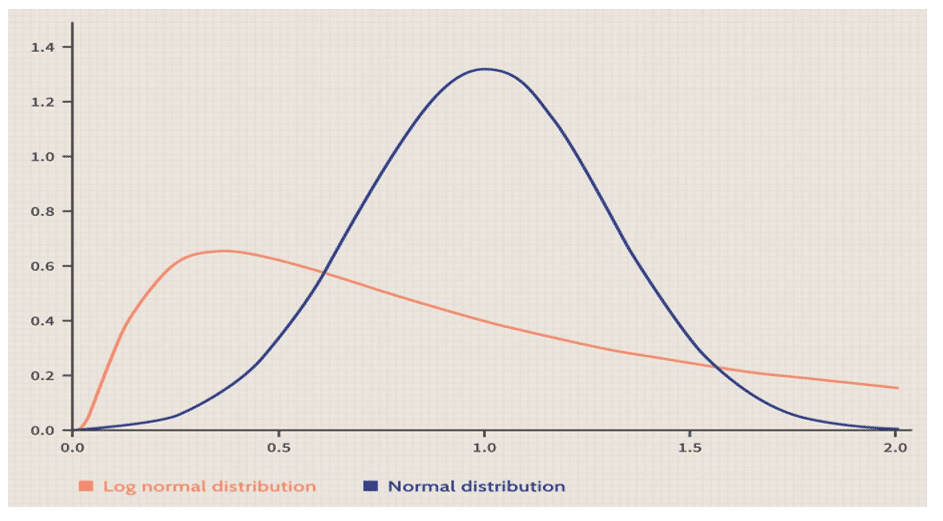

Measures of Central Tendency

Measures of Dispersion

3. Organizing, Visualizing, and Describing Data

Graphical Tools

- Histogram: Visualizes frequency distribution.

- Boxplot: Shows median, quartiles, outliers.

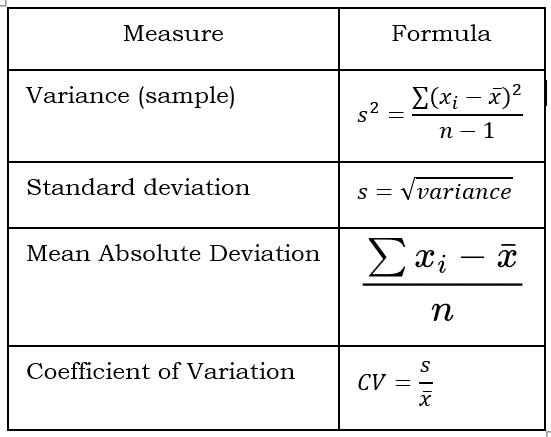

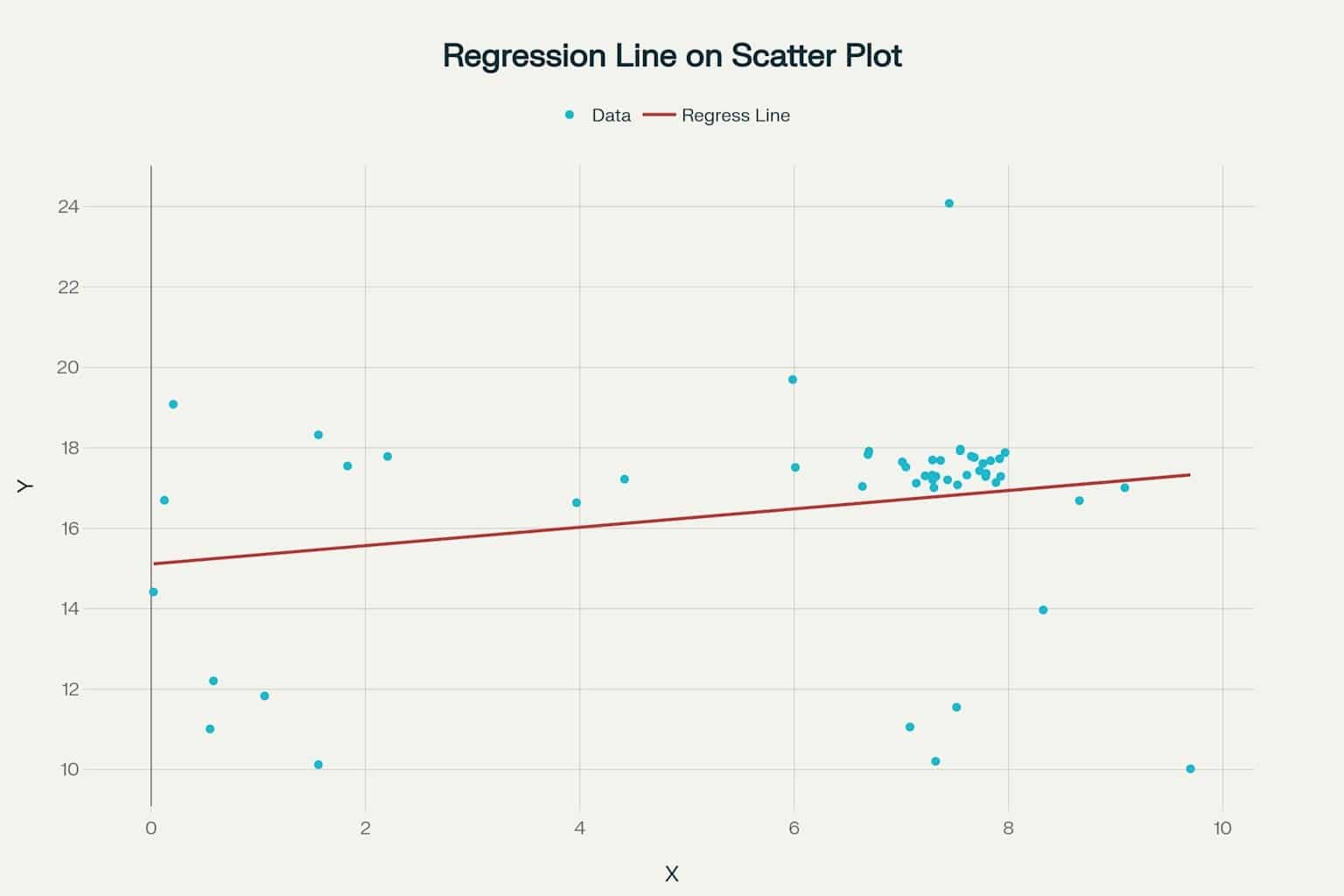

- Scatter Plot: Reveals correlation between two variables.

Scatter Plot Examples

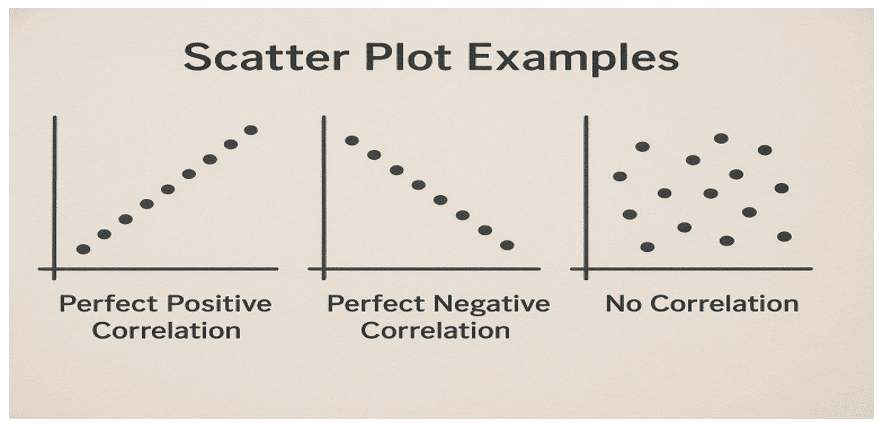

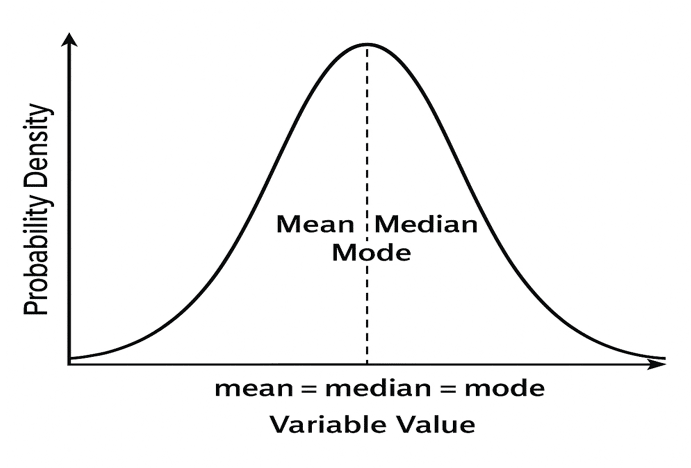

Log-normal vs Normal Distribution

4. Probability Concepts and Distributions

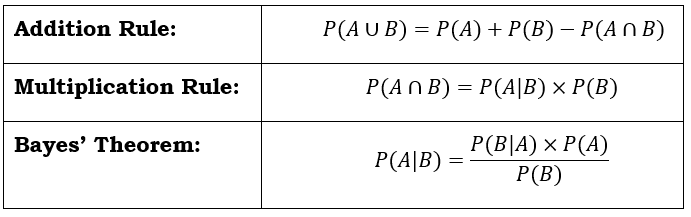

Probability Rules

Distributions

- Discrete: Binomial, Poisson

- Continuous: Normal, lognormal, uniform

Normal Distribution Curve

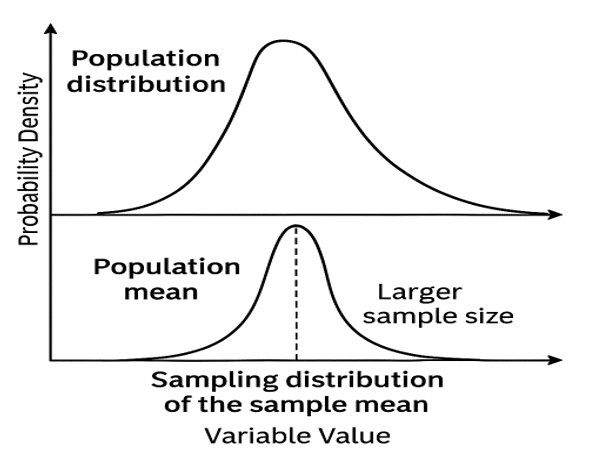

5. Sampling and Estimation

- Sampling Methods: Simple random, stratified, cluster, convenience, judgmental.

- Central Limit Theorem: Sample means approach normality as sample size increases.

- Standard Error:

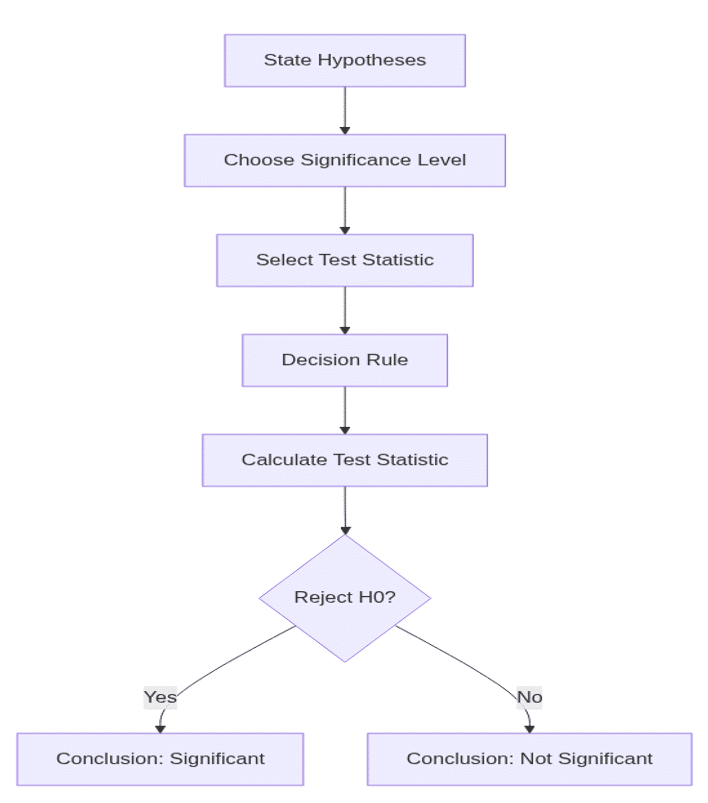

6. Hypothesis Testing

Key Steps

- State null and alternative hypotheses.

- Select significance level, usually 0.05.

- Choose test statistic (z, t, chi-square, F).

- Define decision rule.

- Calculate statistic and make decision.

Types of Errors:

- Type I: Reject when true (false positive).

- Type II: Fail to reject when false (false negative).

Hypothesis Testing Flowchart

7. Parametric vs Non-Parametric Tests

- Parametric: Assume normal distribution, test means/variances (z, t, F, chi-square).

- Non-Parametric: No distribution assumption, use ranks/signs (Wilcoxon, Mann-Whitney).

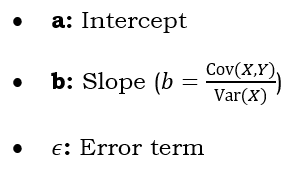

8. Simple Linear Regression

Model:

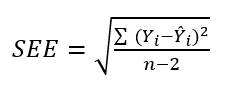

Goodness-of-Fit:

- R-squared (R2 ): % of Y explained by X

- Standard Error of Estimate (SEE):

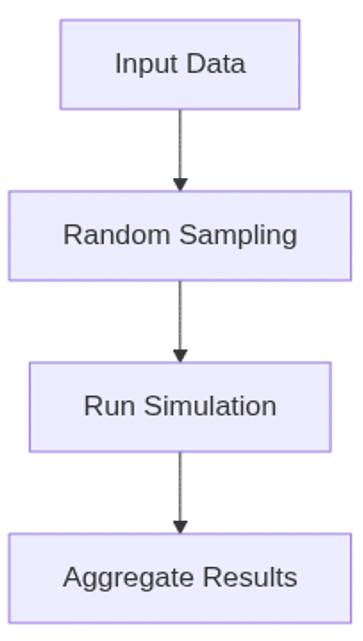

9. Simulation Methods

- Monte Carlo Simulation: Repeated random sampling to estimate outcomes.

- Bootstrapping: Resampling with replacement to estimate statistics.

Simulation Flow

10. Big Data and Machine Learning (Intro)

- Big Data: Large, complex datasets.

- Machine Learning: Algorithms that learn from data.

- Applications: Forecasting, risk management, trading.

11. Key Formula Summary Table

Visual Learning Tips

- Use timelines for TVM problems.

- Draw box-plots and histograms to understand distributions.

- Sketch normal curves and shade areas for probability questions.

- Map out regression lines and scatter plots for relationships.

- Practice with flowcharts for hypothesis testing and simulation

Transform your career with our Investment Banking course in India and secure your dream job as an investment banker!