CFA Level 1

CFA Level 1

Corporate Issuers - Exam Ready Notes

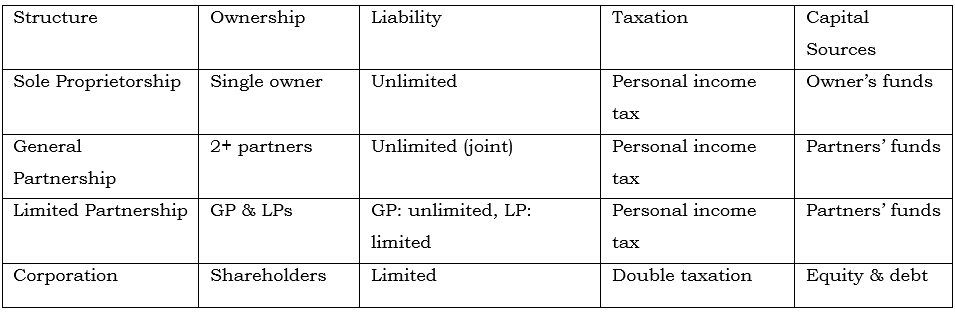

1. Organizational Forms, Corporate Issuer Features, and Ownership

Public vs. Private Companies

- Public: Shares traded on stock exchange, subject to regulatory disclosure, can raise large amounts of capital.

- Private: Fewer shareholders, less regulatory burden, limited access to capital markets.

Lifecycle Stages:

- Startup → Growth → Maturity → Decline

2. Investors and Other Stakeholders

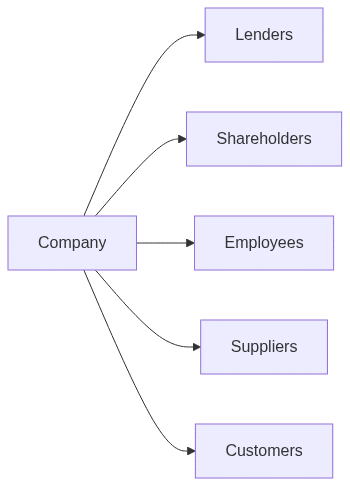

Stakeholder Groups

- Lenders: Provide debt, seek interest/principal, priority in claims.

- Shareholders: Provide equity, seek dividends/capital gains, residual claim.

- Employees: Seek job security, compensation, benefits.

- Suppliers/Customers: Seek stable relationships, product quality, timely payments.

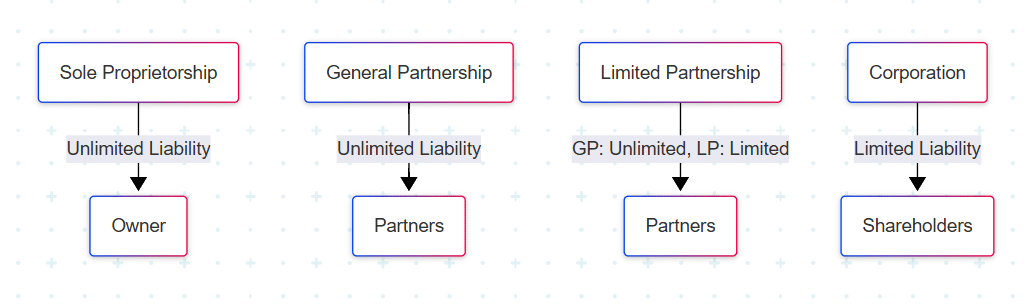

Stakeholder Map

ESG Considerations

- Environmental: Resource use, pollution, climate impact.

- Social: Employee relations, diversity, community impact.

- Governance: Board structure, executive compensation, shareholder rights.

3. Corporate Governance: Conflicts, Mechanisms, Risks, and Benefits

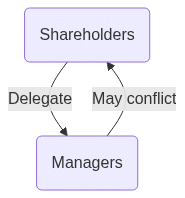

Principal-Agent Conflicts

- Managers (Agents) may pursue personal goals over shareholder interests.

- Mechanisms to Align Interests:

- Board oversight

- Executive compensation linked to performance

- Shareholder voting rights

Agency Conflict

Risks and Benefits

- Risks: Fraud, mismanagement, value destruction.

- Benefits: Efficient capital allocation, risk management, value creation.

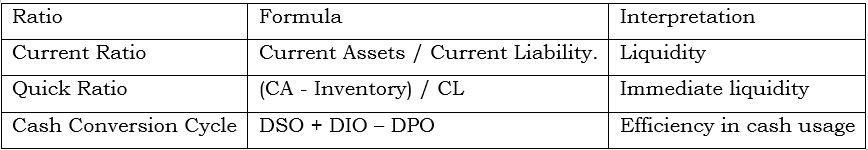

4. Working Capital and Liquidity

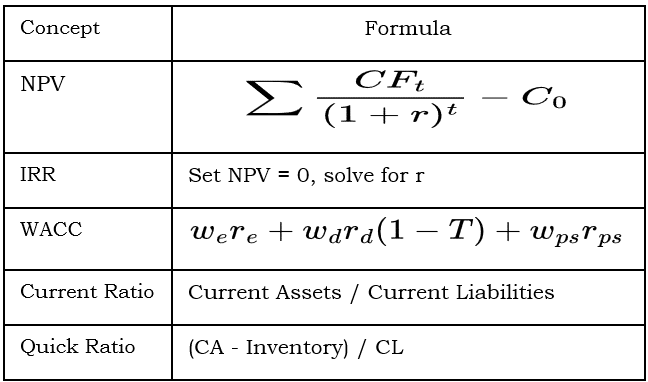

Key Ratios

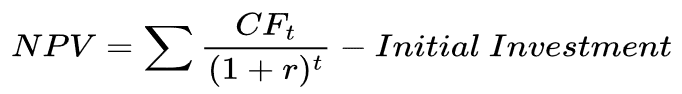

5. Capital Investments and Capital Allocation

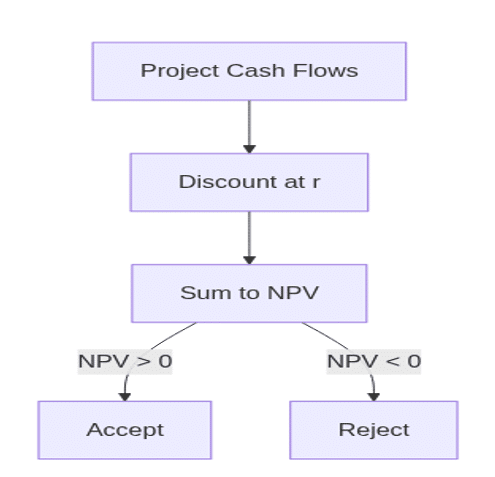

Capital Budgeting Techniques

- Net Present Value (NPV):

- Internal Rate of Return (IRR):

Discount rate that makes NPV = 0.

NPV vs. IRR Decision

Capital Allocation Pitfalls

- Over-optimism in forecasts

- Ignoring risk

- Poor post-investment review

6. Capital Structure

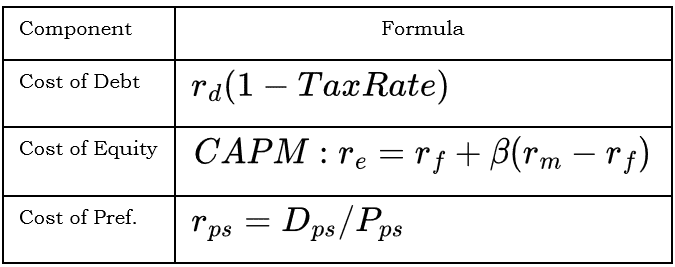

Cost of Capital Components

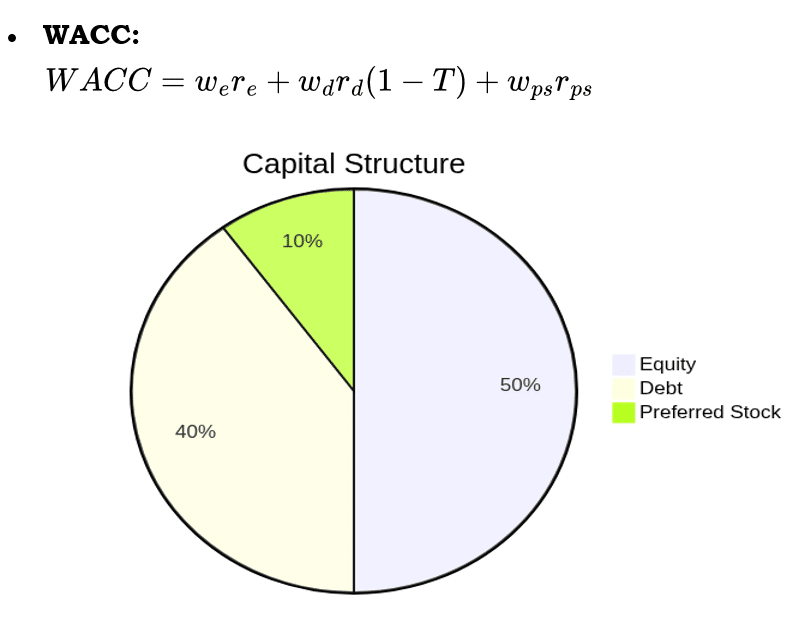

Capital Structure Pie Chart

Theories

- Modigliani–Miller: Capital structure irrelevant in perfect markets.

- Pecking Order: Firms prefer internal financing > debt > equity.

- Trade-off Theory: Balance tax shield of debt vs. bankruptcy risk.

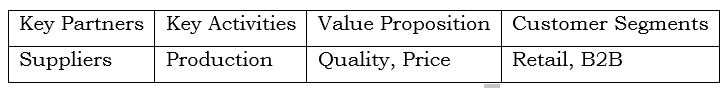

7. Business Models

Types

- Product-based: Sell goods (e.g., manufacturing)

- Service-based: Sell services (e.g., consulting)

- Platform: Connect buyers and sellers (e.g., e-commerce)

- Subscription: Recurring revenue (e.g., SaaS)

Business Model Canvas (Simplified)

Tips:

- Focus on understanding the rationale behind formulas and corporate decisions, not just memorization.

- Practice interpreting ratios and capital budgeting results in real scenarios.

- Use diagrams to visualize business relationships and flows.

Transform your career with our Investment Banking course in India and secure your dream job as an investment banker!