CFA Level 1

CFA Level 1

Alternative Investment - Exam Ready Notes

CFA Level 1 Alternative Investments – Summary Notes

1. What Are Alternative Investments?

Definition:

Assets outside traditional stocks, bonds, and cash.

Categories:

- Private Capital: Private equity, private debt

- Real Assets: Real estate, infrastructure, natural resources

- Hedge Funds

- Digital Assets: Cryptocurrencies, tokens, NFTs, etc.

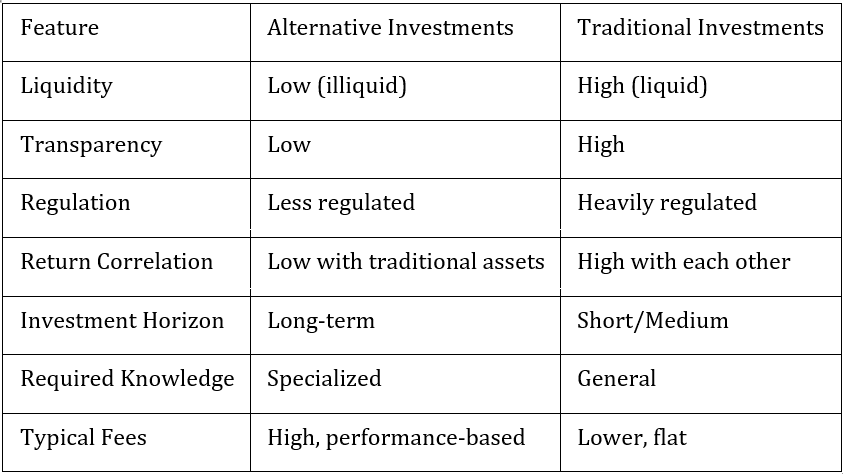

Key Features Table

2. Why Invest in Alternatives?

- Diversification: Low correlation with traditional assets (see correlation matrix below)

- Potential for Higher Returns: Often compensate for illiquidity and complexity

- Inflation Protection: Especially real assets and commodities

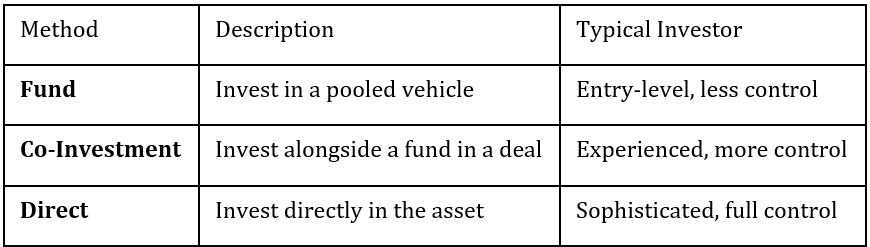

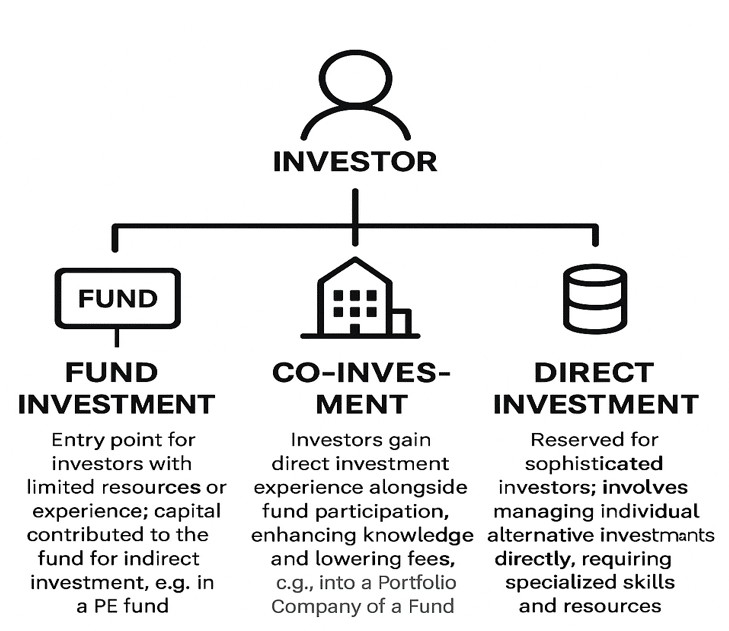

3. Investment Methods

Investment Methods

4. Structures & Compensation

Limited Partnerships (LP/GP):

- GP (General Partner): Manages, unlimited liability, earns management + performance fees

- LP (Limited Partner): Passive investor, limited liability

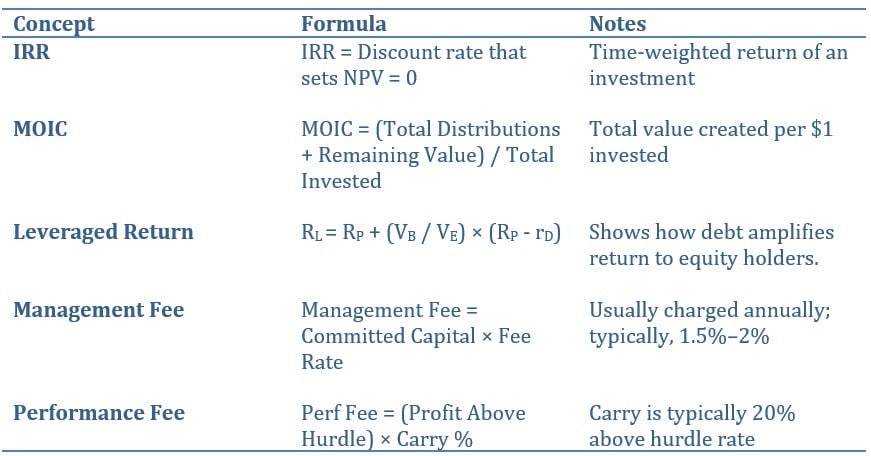

Fee Structure:

- Management Fee: % of committed capital or AUM (1–2%)

- Performance Fee (Carry): % of profits above hurdle (often 20%)

- Hurdle Rate: Minimum return before carry applies

- High-Water Mark: No performance fee unless NAV exceeds prior peak

- Clawback: LPs can reclaim excess performance fees if later losses occur

5. Private Capital

Private Equity

- Venture Capital: Early-stage, high-growth firms

- Buyouts: Mature firms, often with leverage

- Distressed/Turnaround: Struggling firms, restructuring

Key Concepts:

- Exit Strategies: IPO, trade sale, secondary sale, recapitalization, write-off

- Valuation: Comparable companies, precedent transactions, DCF

Private Debt

- Direct Lending: Loans to mid-market companies

- Mezzanine Debt: Subordinated, often with equity kicker

- Distressed Debt: Buying at discount, aiming for restructuring gains

6. Real Assets

Real Estate

- Types: Residential, commercial, industrial, REITs

- Returns: Rental income, capital appreciation

- Valuation: Sales comparison, income approach, cost approach

Infrastructure

- Types: Economic (roads, airports), Social (schools, hospitals)

- Features: Long life, inflation-linked cash flows, public-private partnerships

Natural Resources

- Types: Commodities, farmland, timberland

- Returns: Price appreciation, yield (e.g., crops, timber harvest)

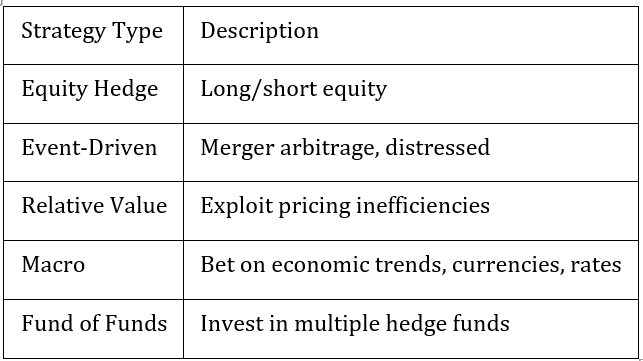

7. Hedge Funds

· Fee Structure: “2 and 20” (2% management, 20% performance)

· Liquidity: Lock-ups, gates, notice periods

8. Digital Assets

- Types: Cryptocurrencies (Bitcoin, Ethereum), tokens, NFTs, stablecoins

- DLT/Blockchain: Distributed ledger, consensus mechanisms (Proof of Work, Proof of Stake)

- Risks: High volatility, regulatory uncertainty, custody/security

9. Performance & Returns

- Return Calculation: Often IRR (Internal Rate of Return) due to irregular cash flows

- MOIC (Multiple on Invested Capital): (Total value returned + remaining value) / total invested

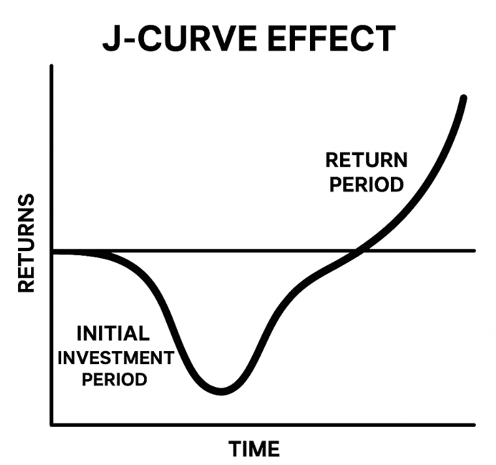

- J-Curve Effect: Initial negative returns (fees, investments), positive returns later

J-Curve Graph (for Word):

- X-axis: Time, Y-axis: Cumulative Return

- Curve dips below zero, then rises above

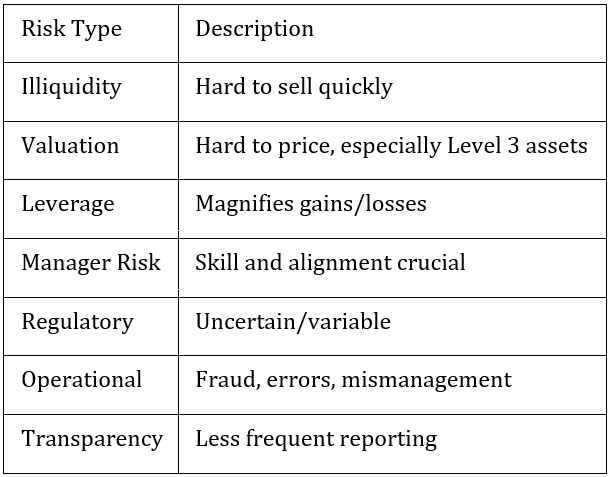

10. Risks in Alternatives

11. Due Diligence

- Assess manager skill, experience, and track record

- Review fund terms, lockups, redemption policies

- Analyze underlying asset risks, valuation methods

12. Key Formulas

Transform your career with our Investment Banking course in India and secure your dream job as an investment banker!