Software development is a precise craft, often slowed by the relentless cycle of writing, testing, and debugging code—tasks that consume more than half of a developer’s time. Today, AI debugging tools are revolutionizing this process, transforming debugging from a reactive chore into a proactive, intelligent workflow that detects and eliminates bugs before they break your code. These tools leverage machine learning, pattern recognition, and extensive datasets to not only identify errors but also predict bugs, suggest fixes, and optimize performance, significantly boosting developer productivity and code quality analysis.

For AI practitioners, software architects, and technology leaders, mastering these tools is critical—not just to stay current but to lead innovation. The right blend of AI capabilities combined with human expertise is essential. This is the core philosophy behind the Software Engineering, Agentic AI and Generative AI Course at Amquest Mumbai, where hands-on learning meets industry-grade mentorship to prepare developers for the future of software engineering.

The Evolution of Debugging: From Manual to AI-Powered

Historically, manual debugging—line-by-line code review, logging, and breakpoints—has been the standard. While effective, it is slow, error-prone, and unsustainable for large, complex codebases. Automated testing improved matters but often generated false positives and required constant maintenance. The advent of AI debugging tools marks a paradigm shift.

Modern tools like DebuGPT and Safurai monitor codebases in real time, flagging issues early and offering context-aware fixes. They go beyond syntax errors to predict logical flaws, suggest architectural improvements, and detect security vulnerabilities before deployment. Reports show developers experience up to 40% faster bug resolution, with tools like CHATDBG fixing defects autonomously 87% of the time.

Despite these advances, AI is not infallible. It excels at pattern recognition but lacks the intuition to understand intent fully. Over-reliance may mask deeper architectural issues or introduce subtle bugs. The most effective approach is collaboration: AI augments human judgment rather than replaces it.

Latest Features, Tools, and Trends in AI Debugging

| Tool/Feature | Key Strength | Real-World Impact |

|---|---|---|

| DebuGPT, Safurai | Real-time, contextual bug detection | Accelerates bug resolution by 40% |

| GitHub Copilot, Cursor | IDE-embedded large language models (LLMs) | Reduces repetitive coding tasks |

| PyCharm (AI-enhanced) | Visual debugging, remote/container support | Simplifies debugging across environments |

| TestSigma | No-code AI-driven test automation | Speeds test creation and maintenance |

| Multi-agent AI systems | Specialized agents for coding, review, docs | Automates large parts of software delivery |

Confidence scoring is emerging as a key feature in 2025, with tools indicating the reliability of their suggestions. This helps developers prioritize fixes and trust AI outputs more effectively. Some tools link fixes to documentation or past successful resolutions, creating a feedback loop that continuously improves accuracy.

Smart error detection now extends beyond simple syntax to infer developer intent, detect race conditions, memory leaks, and propose performance enhancements. Predictive debugging uses historical data to highlight potential trouble spots before code execution—a game changer for mission-critical systems.

Emerging Trends to Watch

- Multi-agent AI systems: Coordinated AI agents handle code generation, review, documentation, and testing, streamlining the entire software development lifecycle.

- Self-healing code: Experimental AI tools attempt automatic correction of certain bug classes without human intervention.

- AI safety and security auditing: A growing specialization ensures AI-generated code meets strict security and compliance standards.

Advanced Tactics for Success with AI Debugging Tools

Best Practices for AI Integration

- Craft Effective Prompts: The quality of AI debugging depends heavily on input. Invest in prompt engineering to create rich, detailed queries that yield relevant fixes.

- Verify, Don’t Trust Blindly: Always review AI-generated suggestions. Use confidence scores and cross-reference with your knowledge base to avoid introducing errors.

- Commit to Continuous Learning: The AI debugging landscape evolves rapidly. Stay updated on new capabilities, tools, and best practices to maintain a competitive edge.

- Balance Automation with Oversight: Use AI to handle repetitive tasks and triage, but reserve complex decisions for human experts who understand architectural nuances.

- Monitor Technical Debt: Accelerated development can introduce subtle long-term issues. Regular code reviews and architectural audits remain essential.

- Foster a Culture of Feedback: Encourage peer reviews, team discussions, and continuous knowledge sharing to maximize AI’s benefits.

Step-by-Step Implementation

- Audit Your Workflow: Identify pain points like slow bug resolution or high false positives.

- Select Suitable Tools: Match AI debugging tools to your tech stack and team size. Start with IDE plugins such as GitHub Copilot or Cursor, then explore standalone platforms like DebuGPT.

- Integrate Gradually: Pilot AI tools on non-critical projects to measure impact on bug resolution time and code quality.

- Train Your Team: Ensure everyone understands AI tool capabilities and limitations through targeted education.

- Iterate and Optimize: Use analytics to refine prompts, tool settings, and review processes based on real-world data.

The Power of Community, Storytelling, and Hands-On Learning

Adopting AI debugging tools is not just a technical shift but a cultural one. Sharing real examples and student success stories accelerates adoption and builds confidence. At Amquest Mumbai, learners engage in hands-on debugging of real-world systems, collaborate on open-source projects, and work with industry partners through internships and live case studies.

This immersive, community-driven approach combines AI-powered learning with expert mentorship, preparing graduates not only to use tools effectively but to lead teams, architect scalable systems, and drive innovation. It transforms abstract AI concepts into tangible skills, turning students into highly sought-after professionals.

Measuring Success: Analytics and Insights

Quantitative metrics demonstrate AI debugging’s impact:

- Faster time-to-resolution for critical bugs

- Higher code quality scores in peer reviews and static analysis

- Reduced developer burnout by minimizing tedious debugging tasks

Qualitative feedback highlights reduced cognitive load and increased focus on creative problem-solving, thanks to continuous AI monitoring that catches issues early.

Business Case Study: AI Debugging Transforms Enterprise Development

Company: Leading fintech startup, Mumbai

Challenge: Rapid growth created complex codebases with frequent production bugs and outages.

Solution: Integrated AI debugging tools into CI/CD pipelines and trained engineers through Amquest’s Software Engineering, Agentic AI and Generative AI Course, emphasizing tool mastery and critical code review.

Results:

- Bug detection time dropped 35%

- Production incidents cut by 50% within six months

- Developer satisfaction soared, enabling more innovation

Key Insight: Technology adoption alone isn’t enough; success depends on upskilled, empowered teams combining AI tools with expert judgment.

Actionable Tips for Developers and Tech Leaders

- Start Small, Scale Smart: Begin with a single AI tool, measure results, then expand.

- Invest in Education: Tools are only as effective as the people who use them. Enroll your team in courses blending theory, labs, and real projects like those at Amquest Mumbai.

- Cultivate a Review Culture: Peer reviews and architectural discussions complement AI, ensuring high-quality outcomes.

- Stay Vendor-Agnostic: Combine multiple tools to avoid lock-in and adapt as technology evolves.

- Leverage Community Knowledge: Participate in forums, meetups, and open-source projects to harness collective intelligence.

Why Choose Amquest’s Software Engineering, Agentic AI and Generative AI Course?

Amquest Mumbai stands out for preparing the next wave of AI-powered software engineers by offering:

- AI-Led, Hands-On Modules: Debug real systems, build agentic AI applications, and deploy generative models in live environments.

- Industry-Experienced Faculty: Learn from practitioners who have designed large-scale AI systems for leading companies.

- Internship and Placement Opportunities: Gain real-world experience through Amquest’s extensive industry network.

- Flexible Delivery: Benefit from a strong Mumbai presence with national reach through online options.

- Future-Proof Curriculum: Stay ahead with content updated for 2025’s latest tools, trends, and best practices.

Graduates emerge ready to lead AI-driven engineering teams with confidence, not just theoretical knowledge.

Conclusion

AI debugging tools are redefining software engineering by delivering automated bug detection, advanced code quality analysis, and predictive debugging at scale. Yet, the greatest impact comes when these tools are wielded by skilled developers who combine AI’s power with critical thinking.

For those ready to lead the future of software innovation, the Software Engineering, Agentic AI and Generative AI Course at Amquest Mumbai offers an unmatched blend of cutting-edge content, hands-on experience, and industry connections. Don’t just keep pace with AI debugging—shape its future.

FAQs

What are AI debugging tools?

AI debugging tools apply machine learning and pattern recognition to automatically detect, diagnose, and sometimes fix bugs, accelerating development and improving code quality.

How do AI-powered debugging tools improve developer productivity?

They flag issues in real time, suggest fixes, and predict bugs before they occur, freeing developers to focus on innovation.

Can AI debugging tools replace human developers?

No. While efficient at pattern recognition and automating repetitive tasks, human oversight remains essential for architectural decisions and compliance.

What risks exist in over-relying on AI for debugging?

Blind trust can lead to overlooked edge cases, new bugs, or security vulnerabilities if AI outputs aren’t thoroughly reviewed.

Which AI debugging tools are most effective in 2025?

Leading tools include DebuGPT, Safurai, GitHub Copilot, and AI-enhanced IDEs like PyCharm, with choice depending on your stack and workflow.

How can I ensure my team uses AI debugging tools effectively?

Combine tool adoption with ongoing education, regular code reviews, and a culture valuing both automation and critical thinking.

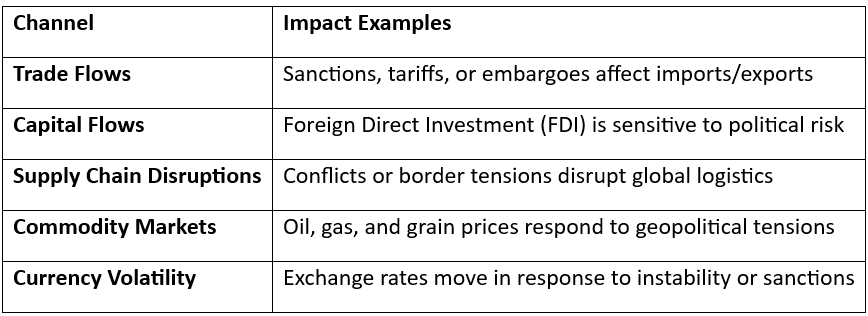

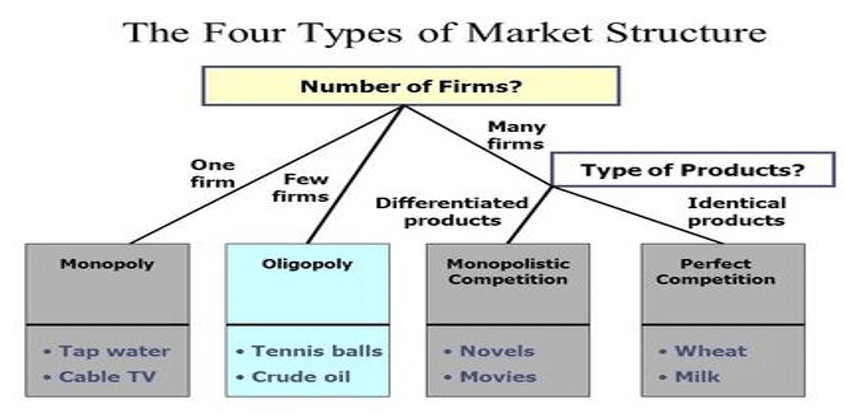

Learning Module 1 – The Firm and Market Structures

Overview

This module introduces different types of market structures and how firms operate and compete within them. It emphasizes pricing power, efficiency, and long-run outcomes across perfect competition, monopolistic competition, oligopoly, and monopoly.

Types of Market Structures

Revenue and Pricing Dynamics

- Perfect Competition: P = MR = AR (firm is price taker)

- Monopoly/Oligopoly: MR < P due to downward-sloping demand

- Profit Maximization Rule: All firms produce where MR = MC

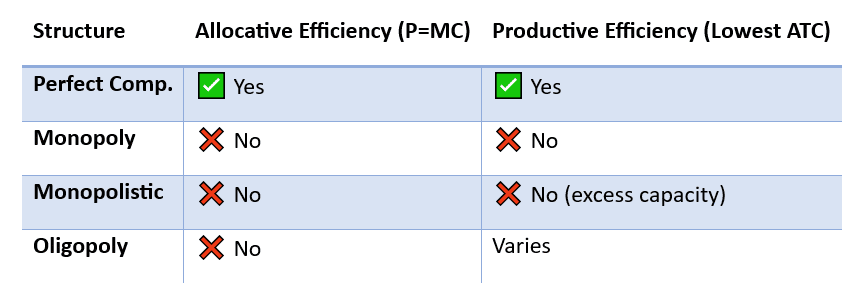

Efficiency Comparison

Long-Run Outcomes

- Perfect & Monopolistic Competition: Zero economic profit in long run

- Oligopoly & Monopoly: May sustain long-run profits due to barriers

Visual: Market Structure Continuum

Additional Concepts

- Concentration Ratios (CRn): % of output by top n firms → higher = less competition

- Herfindahl–Hirschman Index (HHI): Sum of squared market shares → used in merger regulation

- Game Theory in Oligopoly: Strategic interaction like collusion, price wars

Summary Points

- Market structure influences pricing, profits, efficiency, and strategy

- Perfect competition = no pricing power; Monopoly = total pricing power

- Long-run profit depends on entry barriers

Suggested Practice

- Compare MR and MC graphs under different structures

- Classify real-world industries by structure

- Calculate HHI from given market shares

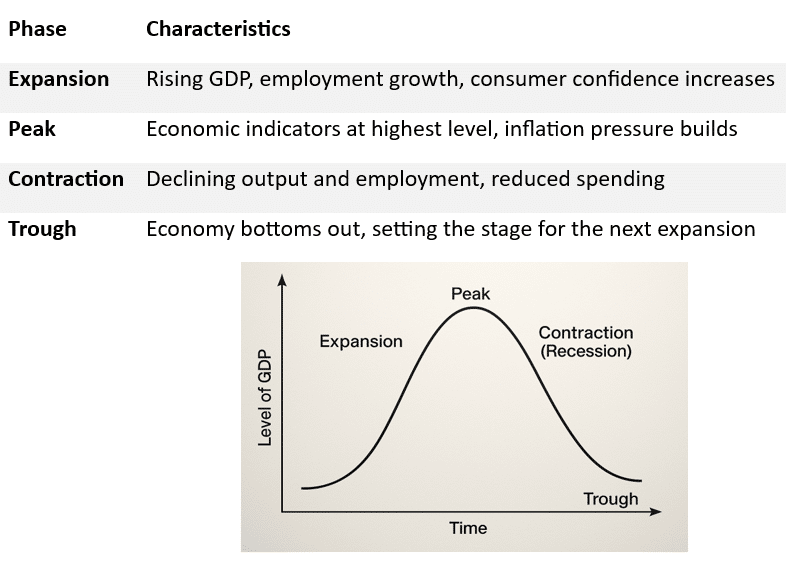

Learning Module 2 – Understanding Business Cycles

Overview

This module explores the phases of business cycles, key macroeconomic indicators, and their implications for economic forecasting and investment decisions.

Business Cycle Phases

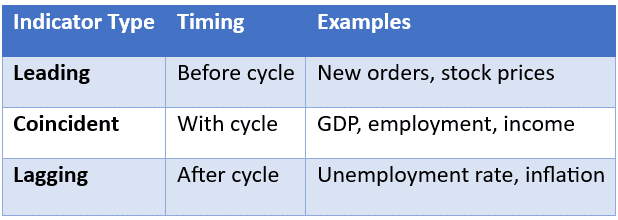

Time Lag of Economic Indicators

Key Macroeconomic Indicators

- GDP Growth – Most comprehensive coincident indicator.

- Unemployment Rate – Lagging, reflects past economic conditions.

- Inflation (CPI, PPI) – Typically lags but can signal overheating.

- Interest Rates – Set by central banks to manage cycles.

- Consumer Confidence & Business Inventories – Often leading indicators

Global Considerations

- Business cycles are not synchronized across countries.

- Global trade and capital flows can transmit cycles internationally.

- Emerging markets may have more volatile cycles due to reliance on commodities.

Role of Central Banks

- Use monetary policy (interest rate, reserve requirements, QE) to smooth cycles.

- Respond more actively during contractions with stimulus measures.

- May tighten policy during expansions to curb inflation.

Real vs. Nominal Variables

- Real variables are inflation-adjusted (e.g., real GDP).

- Nominal variables include inflation and can overstate growth during inflationary periods.

Summary Points

- Business cycles are recurrent but not periodic.

- Key indicators provide signals about the economy’s current and future direction.

- Policy responses differ depending on phase and indicator signals.

Suggested Practice

- Identify current business cycle phase using real-world data.

- Match indicators to their category (leading, coincident, lagging).

- Understand central bank responses under various cycle phases.

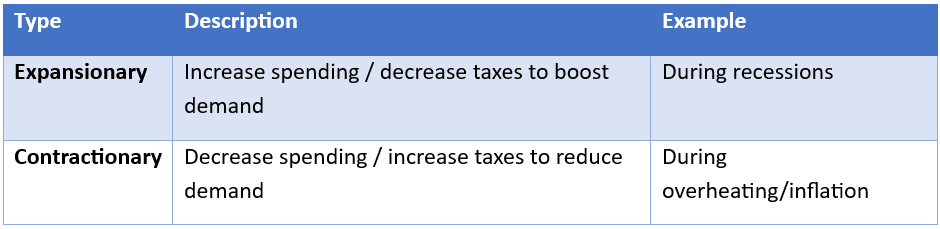

Learning Module 3 – Fiscal Policy

Overview

Fiscal policy refers to the government’s use of taxation and spending to influence the economy. This module examines objectives, tools, types of fiscal policy, and challenges associated with its implementation.

Objectives of Fiscal Policy

- Economic Stabilization: Counter cyclical swings in output and employment.

- Resource Allocation: Government spending to guide production and services.

- Income Redistribution: Taxes and social programs to address inequality.

Tools of Fiscal Policy

- Government Spending: On infrastructure, defense, education, etc.

- Taxation: Direct (income tax) and indirect (VAT, excise duty).

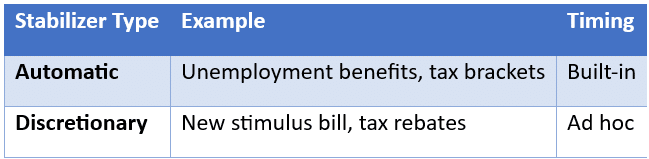

Types of Fiscal Policy

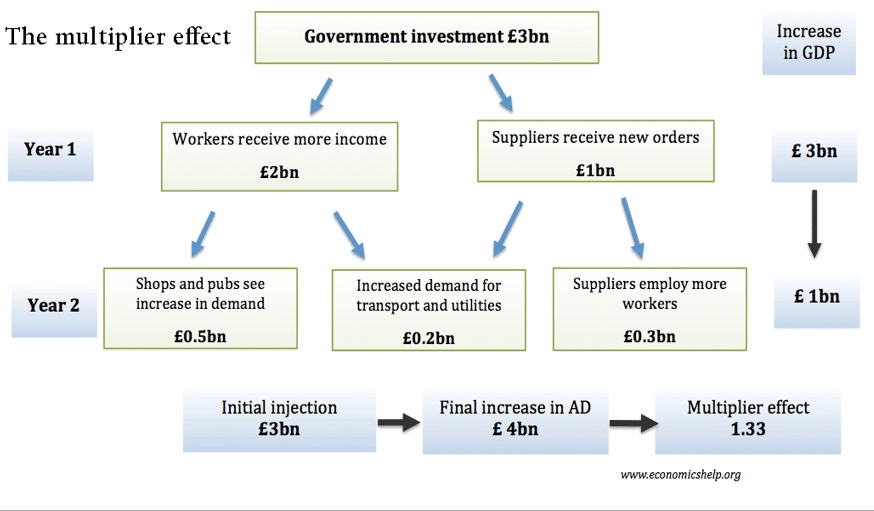

Fiscal Multiplier Effect

Describes the change in GDP resulting from a change in fiscal spending or taxes.

Formula:

Multiplier = 1 / (1 – MPC), Where MPC = Marginal Propensity to Consume

Challenges of Fiscal Policy

- Crowding Out: Govt borrowing raises interest rates, reducing private investment.

- Time Lags: Recognition, decision, and implementation delays.

- Political Constraints: Policy changes may not be economically optimal.

- Ricardian Equivalence: Consumers may save more expecting future tax hikes.

Automatic vs Discretionary Stabilizers

Budget Deficit and Public Debt

- Deficit: Spending > Revenues in a fiscal year.

- Debt: Accumulated deficits over time.

- Sustained high deficits can increase debt-to-GDP ratio.

Summary Points

- Fiscal policy aims at stabilization, allocation, and redistribution.

- Tools: Govt spending and taxation.

- Expansionary policy is used in recessions; contractionary in inflation.

- Multiplier effect magnifies impact of fiscal actions.

- Implementation is often constrained by time lags and politics.

Suggested Practice

- Calculate multiplier given MPC.

- Analyze scenarios where fiscal policy may be ineffective.

- Identify automatic vs discretionary stabilizers in real-world situations.

Learning Module 4 – Monetary Policy

Overview

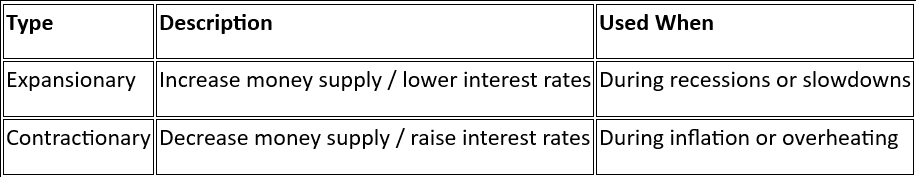

Monetary policy involves the central bank’s use of tools to influence money supply, interest rates, inflation, and overall economic activity. This module explores the goals, transmission mechanisms, tools, types, and limitations of monetary policy.

Objectives of Monetary Policy

- Price Stability: Control inflation and maintain purchasing power.

- Economic Growth: Support sustainable output and employment.

- Full Employment: Minimize unemployment without triggering inflation.

- Exchange Rate Stability: Particularly in open economies.

Tools of Monetary Policy

- Open Market Operations (OMO): Buying/selling government securities.

- Policy Rates: Repo rate, discount rate adjustments.

- Reserve Requirements: Ratio banks must hold in reserve.

- Forward Guidance: Communicating future policy intentions.

Monetary Policy Transmission Mechanism

How central bank actions affect aggregate demand and inflation.

Transfer mechanism:

Time Lags

- Inside Lag: Delay in recognizing problem and implementing policy.

- Outside Lag: Delay between implementation and observable effects.

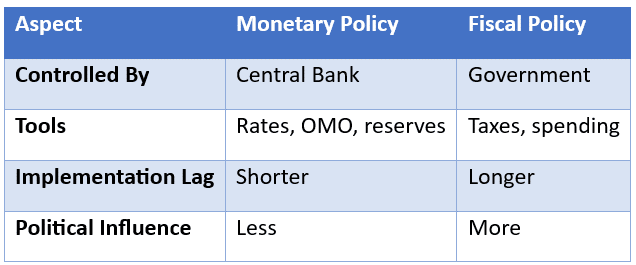

Monetary vs Fiscal Policy

Inflation Targeting

- Central banks set explicit inflation targets (e.g., 2%)

- Builds credibility, predictability, and transparency

- Anchors expectations and improves long-term planning

Limitations of Monetary Policy

- Liquidity Trap: Very low rates fail to stimulate demand

- Time Lags reduce effectiveness

- Global Spillovers: Cross-border capital flows may dilute domestic impact

Summary Points

- Goals: price stability, economic growth, employment, stable currency

- Tools: policy rates, OMOs, reserve ratio, guidance

- Expansionary = rate cuts; Contractionary = rate hikes

- Policy works via transmission to consumption, investment, inflation

Suggested Practice

- Compare monetary tools across economies

- Trace impact of rate changes using transmission flow

- Evaluate effectiveness in real-world low-interest environments

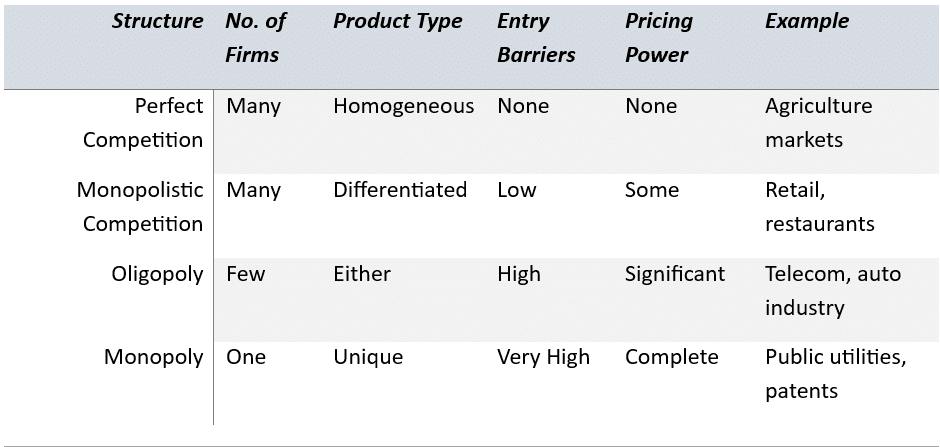

Learning Module 5 – Introduction to

Geopolitics

Overview

This module explores how geopolitical factors influence economic activity, financial markets, and investment decisions. Understanding these dynamics helps analysts assess country-level risks and opportunities.

Definition of Geopolitics

Geopolitics refers to the study of how geographic, political, economic, and strategic factors influence the behavior of nations and international relations.

Core Elements of Geopolitical Analysis

- Geography: Natural resources, access to trade routes, neighbors

- Politics: Government stability, political ideologies, policy direction

- Military Power: Defense spending, global positioning, alliances

- Economic Capabilities: GDP size, trade balance, energy independence

- Institutional Strength: Legal systems, regulatory environment

Economic Channels Affected by Geopolitics

Geopolitical Risk and Investment Decisions

- Country risk assessments include political stability, policy consistency, legal predictability

- Geopolitical uncertainty increases risk premiums and market volatility

- Diversification across regions can mitigate specific geopolitical risks

Tools to Analyze and Mitigate Geopolitical Risk

- Country Risk Ratings (e.g., S&P, Moody’s)

- Geopolitical Risk Index (GPR) – Measures frequency of newspaper coverage of tensions

- Scenario Analysis – Simulate outcomes based on different geopolitical developments

- Hedging Strategies – Currency hedges, commodity derivatives

Historical Case Examples

- Russia-Ukraine Conflict: Oil, gas, and wheat price surges; sanctions disrupt banking systems

- US-China Trade War: Tariff impacts on tech and agriculture; supply chain reconfiguration

- Brexit: Regulatory uncertainty and capital flight from the UK

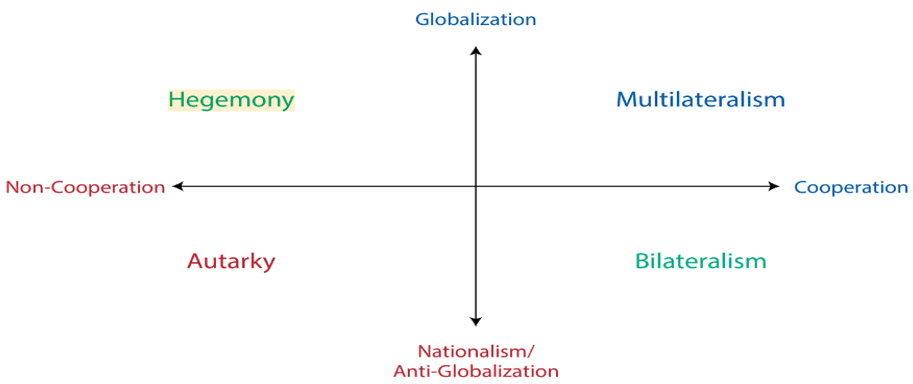

Visual: Geopolitical Risk Influence Map

Summary Points

- Geopolitics shapes trade, capital flows, and investor sentiment

- Key risks: instability, war, sanctions, policy shifts

- Investors can mitigate risk via diversification and hedging

- Analysts use both quantitative and qualitative tools to assess geopolitical exposure

Suggested Practice

- Track a current geopolitical event and map its financial impact

- Compare risk ratings of multiple countries

- Use scenario analysis to forecast asset behavior in response to rising tensions

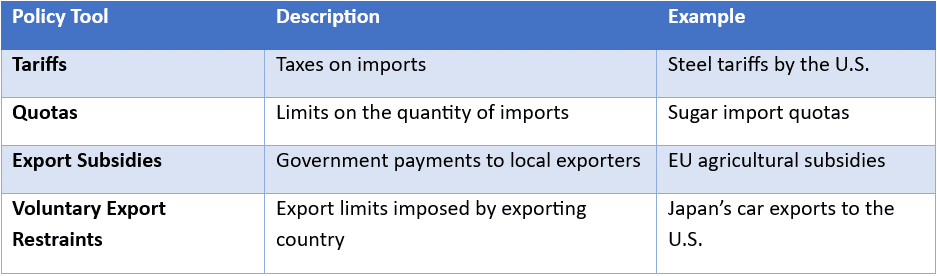

Learning Module 6 – International Trade

Overview

This module introduces key principles of international trade, the benefits and costs of trade, trade restrictions, and how trade policies affect economic outcomes. It also explores how countries specialize based on comparative advantage.

Key Concepts

- Absolute Advantage: When a country can produce a good using fewer resources than another.

- Comparative Advantage: When a country can produce a good at a lower opportunity cost.

- Gains from Trade: Arise when countries specialize and exchange based on comparative advantage.

Types of Trade Restrictions

Economic Effects of Trade Restrictions

- Consumer Surplus Falls: Higher prices and less choice

- Producer Surplus Rises: Domestic firms gain market share

- Deadweight Loss: Overall economic inefficiency

- Retaliation Risk: May trigger trade wars

Trade Agreements and Organizations

- WTO (World Trade Organization): Promotes free trade and settles disputes

- FTA (Free Trade Agreement): Reduces/eliminates tariffs between countries

- Customs Union: Common external tariffs + free trade within bloc

- Common Market: Customs union + free movement of factors of production

Balance of Payments (BoP)

Records all economic transactions between residents of a country and the rest of the world.

Main Components:

- Current Account: Goods, services, income, transfers

- Capital Account: Transfers of capital assets

- Financial Account: Investments, reserves, loans

Trade Deficits vs Surpluses

- Trade Deficit: Imports > Exports → Currency depreciation pressure

- Trade Surplus: Exports > Imports → Currency appreciation pressure

Summary Points

- Comparative advantage drives specialization and trade

- Restrictions distort market outcomes and reduce global welfare

- BoP tracks economic flows between nations

- Trade policies have domestic winners and losers

Suggested Practice

- Identify winners and losers from a new trade restriction

- Analyze impact of tariff using supply/demand diagrams

- Understand BoP structure and interpret current account trends

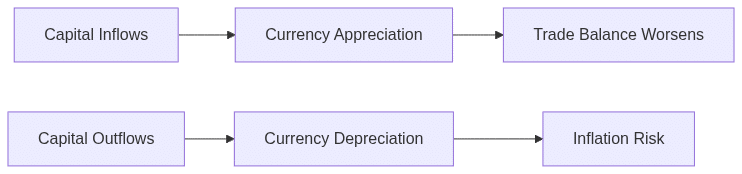

Learning Module 7 – Capital Flows and Foreign Exchange Markets

Overview

This module explores how capital flows and foreign exchange (FX) markets operate. It covers currency markets, exchange rate systems, and the impact of capital mobility and currency regimes on macroeconomic stability.

Key Concepts

- Capital Flows: Movement of funds across borders for investment (FDI, portfolio flows, loans)

- Foreign Exchange Market: Global decentralized market for currency exchange

- Exchange Rate: Price of one currency in terms of another

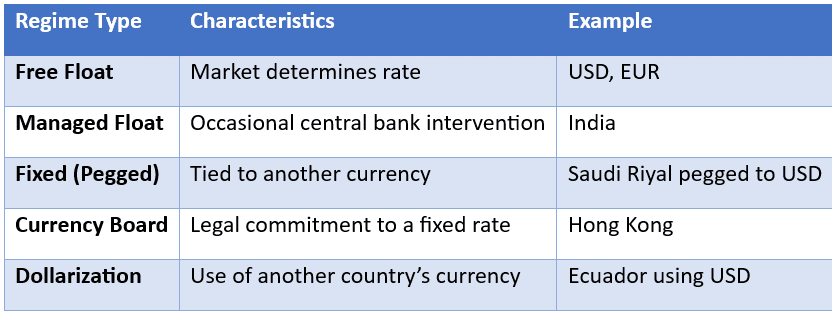

Types of Exchange Rate Regimes

Capital Controls

- Administrative Tools used to limit capital movement

- May include restrictions on FDI, taxes on capital flows, or quantitative limits

- Aimed at managing exchange rate volatility, financial stability

Impact of Capital Flows

- Positive: Brings foreign investment, improves productivity

- Negative: Sudden stops or reversals can lead to crises

- Volatile Capital Flows can disrupt exchange rate and monetary stability

FX Market Features

- Major Participants: Central banks, commercial banks, hedge funds, corporations

- Instruments: Spot, forward, swap, options

- Market is OTC: Decentralized and operates 24/7 globally

Currency Appreciation vs Depreciation

- Appreciation: Currency value rises → Imports cheaper, exports hurt

- Depreciation: Currency value falls → Exports benefit, inflation risk rises

Visual: Capital Flow and FX Rate Influence

Summary Points

- FX markets are critical for global trade and investment

- Exchange rate regimes vary by country’s macro priorities

- Capital flows offer benefits but also pose systemic risks

- Central banks intervene to stabilize currency and protect reserves

Suggested Practice

- Differentiate between FX regimes using real-world cases

- Analyze effects of capital inflow surge on currency and inflation

- Interpret forward rates and spot FX transactions

Learning Module 8 – Exchange Rate Calculations

Overview

This module focuses on how exchange rates are quoted and calculated, and how to perform currency conversions and cross-rate calculations. It also introduces the concept of bid–ask spreads and forward rates.

Exchange Rate Quotations

- Direct Quote: Home currency per unit of foreign currency (e.g., INR 80/USD)

- Indirect Quote: Foreign currency per unit of home currency (e.g., USD 0.0125/INR)

- Base Currency: The currency being bought or sold (e.g., USD in INR/USD)

- Price Currency: The currency in which the quote is expressed

Currency Conversion Formula

Price in Home Currency = Price in Foreign Currency × Exchange Rate

Example:

100 USD × 80 INR/USD = ₹8,000

Cross Rate Calculations

Used when direct quote is not available. Calculate using common base:

Currency A / Currency C = (Currency A / Currency B) × (Currency B / Currency C)

Example:

EUR/JPY = EUR/USD × USD/JPY

Bid–Ask Spread

- Bid: Price dealer is willing to pay

- Ask: Price dealer is willing to sell

- Spread: Ask – Bid (profit for dealer)

Formula (in % terms):

Bid–Ask Spread % = [(Ask – Bid) / Ask] × 100

Forward Exchange Rates

- Agreed today, exchanged in future

- Quoted as premium/discount over spot

- Helps hedge FX risk in future transactions

Forward Premium/Discount Formula:

Forward Premium (%) = [(Forward – Spot) / Spot] × (360 / Days) × 100

Summary Points

- Understand quote formats (direct vs indirect)

- Perform conversions and cross-rate calculations

- Interpret bid–ask spreads and compute % spread

- Know how forward rates are used and calculated

Suggested Practice

- Convert using direct and indirect quotes

- Solve cross-rate problems

- Calculate bid–ask spreads and forward premiums